Insurance Agent vs. Real Estate Agent:

Regarding flexible career opportunities with high earning potential, insurance sales and real estate offer rewarding paths. Each field involves sales, relationship-building, and the ability to manage your own business. However, the licensing process, required skills, startup costs, and long-term career trajectories differ significantly. Understanding the key differences will help you decide which path best aligns with your goals.

Insurance and real estate sales professionals are typically commission-based, meaning they earn income only when they successfully close a sale or transaction. Unlike salaried or hourly positions, there is no guaranteed paycheck—your income depends directly on your performance. Most commission-based professionals are classified as 1099 independent contractors, which means taxes are not automatically withheld from their earnings. As a result, they are responsible for setting aside funds to cover income taxes, Social Security, and Medicare obligations. Additionally, being self-employed often means not receiving employer-provided benefits like health insurance, retirement contributions, or paid time off. Proper budgeting and financial planning are essential to manage irregular income, save for taxes, and secure personal insurance coverage.

Real Estate Agent

To become a real estate agent, you must meet specific state licensing requirements. Typically, this includes having a high school diploma or GED, completing a state-approved pre-licensing course (often 60 to 90 hours), and passing the real estate licensing exam. In addition to licensing, in some states, agents must undergo fingerprinting and a background check; in some cases, a clean criminal record may be mandatory. Ongoing continuing education is also required—usually every two years—to maintain an active license and stay current with changing regulations.

The costs to become a real estate agent can vary depending on the state and brokerage. Still, they typically include pre-licensing course fees, state exam fees, membership dues to the MLS (Multiple Listing Service) and the National Association of Realtors (NAR), and Errors and Omissions (E&O) insurance. Additionally, many brokerages charge monthly desk fees to agents, which can range significantly. Some agents may also encounter additional brokerage-specific costs or marketing fees. The timeline from taking courses to being an active, licensed agent depends, sometimes up to a year. The courses required can be per semester. However, if you can find a program online that you can do at your own pace, it could be faster.

On the career path side, new agents usually start under the supervision of a licensed broker and may eventually become brokers themselves. Skills essential to succeed include strong communication abilities, negotiation skills, knowledge of local housing markets, and a drive for networking and salesmanship.

Insurance Sales Agent

In comparison, becoming an insurance sales agent also requires a state-issued license. The licensing process typically involves completing a pre-licensing course—though the required number of hours varies by state—and passing a state licensing exam for specific types of insurance, such as life, health, property, or casualty. Insurance licensing also requires fingerprinting and a thorough background check, with certain criminal offenses possibly preventing individuals from obtaining licensure. Continuing education is a standard requirement, with frequency dependent on state regulations, to maintain active licensure.

Startup costs for insurance agents typically include pre-licensing education fees, licensing and exam fees, fingerprinting and background check costs, and mandatory E&O insurance. Depending on where and how an agent conducts business, additional costs such as appointment fees, agency fees, and marketing expenses may also apply. Insurance agents may work independently, align with a specific insurance carrier (as a captive agent), or become brokers offering policies from multiple carriers. The timeline from coursework to becoming active can range as early as 3 weeks to however long it takes, depending on the level of effort and urgency of the person trying to become an agent.

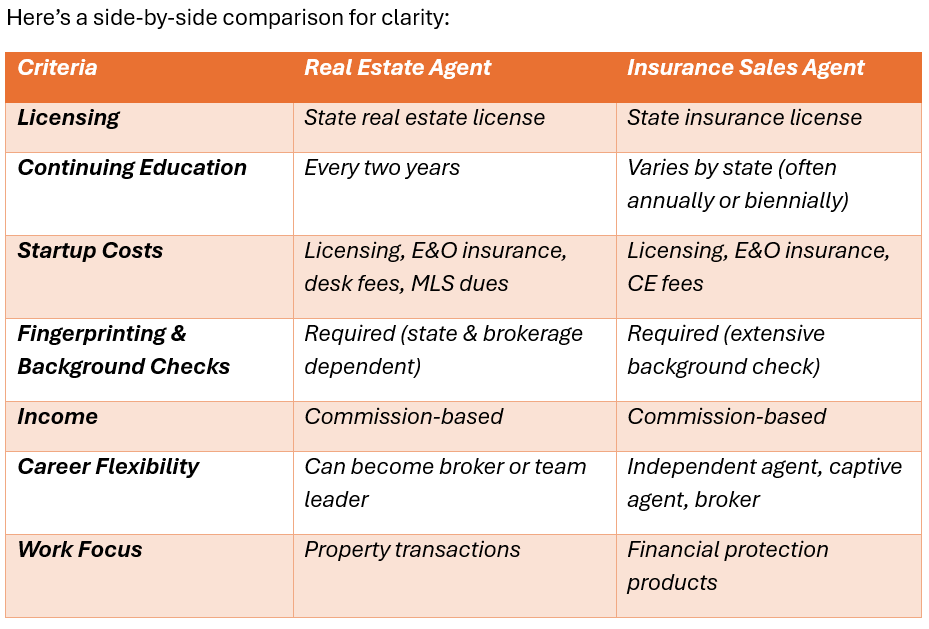

Both career paths share some key similarities—they are commission-based, require licensing and continuing education, and involve client relationship management and sales skills. However, their day-to-day responsibilities and long-term growth opportunities are distinct. Real estate agents focus on property transactions, while insurance agents deal with financial protection products like life and health insurance policies.

Ultimately, both fields offer financial independence, career growth, and flexibility. However, understanding the differences in startup costs, licensing requirements, ongoing expenses, and day-to-day responsibilities will help you make an informed choice. It’s important to research the specific requirements in your state and any additional criteria set by brokerages or insurance agencies to ensure a successful start in either career.

Sources

National Association of Realtors. “Become a Real Estate Agent.” NAR, http://www.nar.realtor/become-a-real-estate-agent. Accessed 25 Mar. 2025.

National Association of Insurance Commissioners. “Becoming a Licensed Insurance Producer.” NAIC, http://www.naic.org/consumer/licensing.htm. Accessed 25 Mar. 2025.

[State-Specific Department of Insurance Website(s), as applicable].

Leave a comment